Blog: Advans further develops its omnichannel model and boosts digital channels

At Advans, we believe that quality customer service should always reflect clients' unique profiles and specific needs. Our omnichannel model, relying on a hybrid approach that combines both digital technologies and the human touch, is a key driver to increase accessibility of our products and services.

2020 saw a steady increase in transactions outside of branches, especially through digital channels

2020 was a difficult year with the Covid 19 crisis resulting in local restrictions, and in particular lockdowns, meaning that some of our branches were inaccessible or had restricted opening hours for long periods. In this context, channels outside of branches played a key role in continuing to serve our clients. Advans’ subsidiaries identified this difficulty from the first days of the crisis and concentrated their efforts on boosting complementary channels for example by allowing remote subscriptions or reducing client fees and accelerating ongoing related projects.

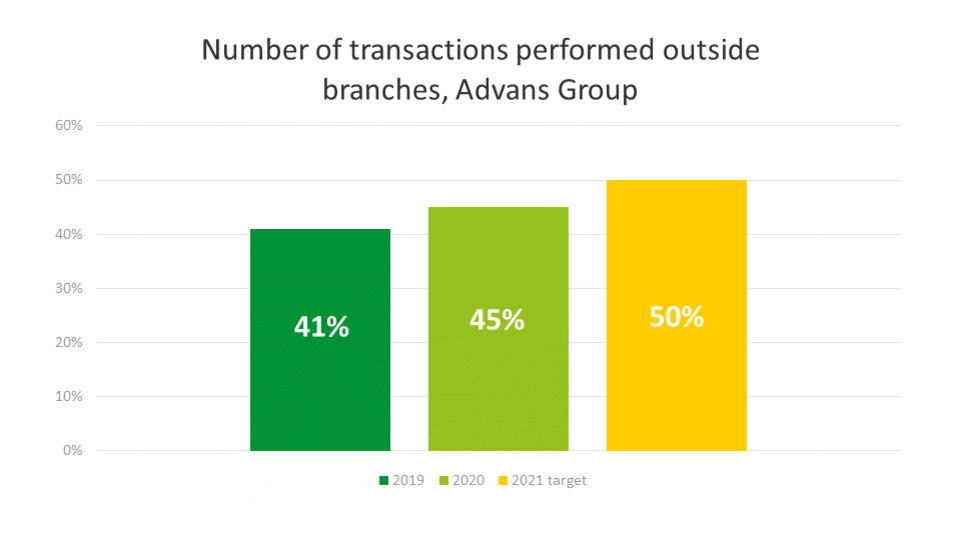

As a result, the contribution of channels outside of branches has strongly increased. By the end of the year, these channels accounted for 45% of total transactions in number at group level (+12% compared to December 2019). Focusing on digital channels, their contribution is 25% of total transactions (+38% compared to December 2019).

New and optimized channels

Advans subsidiaries did not only launch new channels (with a special 2020 focus on agency banking and partnerships with e-wallet providers), but also worked on the optimization of existing channels and internal governance, as well as client education.

For example, Advans Cameroun launched Advans Money, a partnership with Orange Mobile Money, in January 2020, and one year later transactions via this channel represent 25% of total transactions. In Advans Ghana, Mobibank, the MFI’s USSD menu contributed to 32% of total transactions, up from 23% last year, thanks to technical improvements and promotion by field tellers, who now educate and train clients on how to use the service. Advans Myanmar now has 2 partner agency banking networks where clients can repay their loans, Wave and Ongo, which account for 15% of repayments.

Contribution to deposits, account opening and nano loans

Channels outside branches strongly contribute to facilitating savings and loan repayment, and field tellers play an additional role in promoting digital channels.

These channels are more and more drivers of client acquisition and cross selling of services. Field tellers, for instance, can open deposit accounts on the field and in Amret they can even provide nano loans to their clients. More services are available through digital channels: Advans Côte d’Ivoire’s USSD menu already enables clients to apply for and receive a digital emergency loan or, for cocoa producers, a digital school loan. There are also plans for Amret’s and Advans Nigeria’s mobile apps to implement digital account opening and digital nano loans in 2021.

Ambitious objectives for 2021

By the end of 2021, Advans aims to increase the number of transactions taking place outside of the branch to 50%. To achieve this ambitious objective, subsidiaries have defined dedicated action plans and will coordinate closely with the branch network to reinforce their omnichannel approach.

At the same time, the group is going through a global digital transformation program, which will build the foundation for even better performance of the different channels, increase the range of available products and services and give Advans more flexibility to continue to adapt to our clients’ evolving needs. As part of this program, Advans will launch a group mobile app in order to boost client engagement, cross selling and, in the medium-term client acquisition. While use of digital channels is expected to grow fast in the coming years, 16% of our clients have already increased their use of digital channels, and 56% expect it to increase further (according to the 60 Decibels survey done in 2020 with over 3,000 clients). Our high-touch high-tech approach remains our key driver for accelerating financial inclusion.

Our blogger: Ekaterina Diakonova, Alternative Distribution Channels Expert, Advans Group

Ekaterina Diakonova joined Advans in 2018 as Alternative Distribution Channels Expert. Her focus areas include omni-channel strategy, monitoring and support of the Advans’ subsidiaries in the implementation of local initiatives.