Our services

Advans offers a wide range of simple and easy to access financial services tailored to clients’ needs.

Responsible finance

From micro loans to SME loans to current accounts, savings plans, insurance, transfers and much more, Advans aims to offer small businesses and other clients tailored financial services to help them grow their businesses and achieve their professional or personal goals. Advans affiliates constantly update the range of financial services on offer to ensure that clients always find the products they need. At Advans we employ a client centric approach, using client feedback to improve our services, tailoring them to the specific needs of each of our target segments.

Accessible financial services trusted by clients across the globe

Loans

Savings

Insurance

Transactions

Innovation

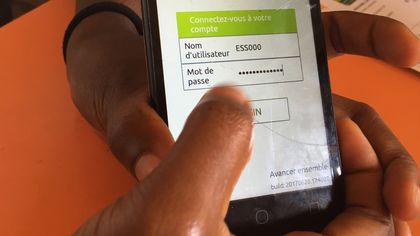

We are currently focusing on the digitalisation of our products, processes and procedures to increase efficiency and outreach and better understand and respond to client needs in fast developing markets. The introduction of a new Core Banking System will speed up our development on four key strategic levels:

- Digitalisation of the loan process

- Digital credit scoring

- Development of business intelligence systems

- Alternative (including digital) delivery channels

Rural expansion

Now that Advans affiliates have built a strong structure and have reached financial stability in urban centres, they are focusing on scaling up their activities and increasing their outreach in semi-rural and rural areas where there is high potential for growth and impact. So as to serve clients in these areas in a sustainable and responsible manner, Advans aims to:

- Develop tailored credit and deposit products

- Address the needs of rural families

- Introduce innovative, appropriate delivery channels

Education

As part of its strategy to diversify its credit offer to better respond to clients’ personal needs Advans has chosen to focus on education. Advans sees education as one of the main contributors to economic and social development. Some of Advans affiliates have begun to develop education finance in the past few years, with support from the group and external partners. Tailored products have been created for:

- School establishments with financing for investments and short term treasury loans

- Parents, to support them in the payment of school fees