Stay home, Stay digital, Stay safe

Accelerating digital transformation during the Coronavirus crisis

Due to the restrictive measures introduced by governments in all of our countries of operation to prevent the spread of Covid-19, many of our branches have had to reduce or suspend services. Channels outside branches, and specifically digital ones, have therefore become key during this time to maintain client contact and access to accounts.

Encouraging the use of digital channels during the crisis

Since the first days of the pandemic Advans has promoted the use of digital channels for loan repayments, deposits and withdrawals, launching specific communication campaigns through SMS, social media and call centre channels focusing on the messages: Stay Home, Stay digital, Stay safe.

We have taken key actions to:

- Facilitate onboarding processes for clients who had not previously signed up for channels, several subsidiaries made subscription to channels easier by enabling clients to subscribe remotely rather than in branch. At Advans Ghana for example customers can now subscribe to the USSD mobile banking menu via the Call Center.

- Make tariffs even more attractive to encourage use. Advans Côte d'Ivoire has made subscription to the USSD mobile banking menu free and Advans Nigeria offers bill payments via the Advans Mobile application with no charges.

- Where possible and necessary, accelerate the deployment of alternative channels likein Myanmar, where Advans Myanmar has extended its pilot with Ongo, enabling clients to repay their loans via third party agents or a mobile app whereas Advans Tunisie has begun a pilot with a payment services provider.

While transactions have decreased in number overall due to the health crisis, thanks to the actions mentioned above, the contribution of digital channels has increased significantly when compared to January 2020. Some of the trends we have noticed from January to April include:

- In Ghana, the number of active users for Advans USSD mobile banking menu increased by 97%. This channel now represents 52% of the total transactions in number vs. 21% in January.

- In Nigeria, the number of subscribers to the Advans Mobile application increased by 11%, with 47% of all transactions in number taking place via this channel.

- In Cambodia, the number of subscribers to Amret Mobile application increased by 50% with 14% more active users, the volume of transactions via this channel increasing by 35% over the period.

- In Cameroun, the Advans Money USSD menu, integrated with Orange Money, was launched in January and already represents 28% of total transactions in number.

- In Cote d’Ivoire, the number of transactions through the Advans USSD mobile banking channel increased to 33% compared to 22% in January.

Maintaining close contact with our clients through a new digital tool

Less physical contact is possible with clients during this time, so we have been looking for innovative solutions to stay connected to them. Advans Client Relationship Officers (CROs) have been following up closely with clients via phone calls to understand their individual situations, but with a high number of staff working remotely and banking and CRM systems mostly only accessible in branches, access to client information has been an issue.

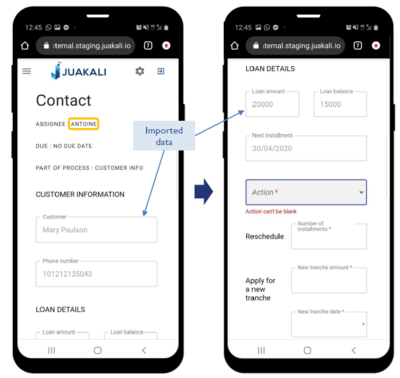

To respond to this problem, we have piloted a partnership with Juakali, a digital provider, to create a tailored cloud based platform which can be quickly deployed enabling staff to organise their client follow up and remotely access all information on their clients. The platform, accessible on a smart phone or computer, is adapted for CROs working remotely and facilitates data sharing and communication between CROs and head office teams. This tool makes client monitoring more efficient and easy during the crisis and will be key in helping each subsidiary analyse the impact of Covid-19 on clients.

A first implementation of the platform has been tested in Tunisia to monitor client feedback on the grace period, with information on more than 12,000 clients collected in less than 7 days. We will deploy the platform in our other greenfields in the coming weeks.

A digital acceleration which will prepare us for the future

The Covid-19 crisis has clearly highlighted the importance of digital channels and tools for microfinance providers and has also encouraged clients who were not previously using digital channels to give them a try. We are already benefitting from the lessons learnt during this challenging time to reinforce Advans’ high tech, high touch omni-channel strategy for the future.