Gender-smart financial inclusion: key learnings from Advans’ experience

In 2020, UN Women announced that poverty rates would widen between men and women in the wake of the Covid 19 Pandemic.[1] This prediction was in line with the results of Advans’ Covid impact survey[2] which showed that while women were slightly less affected at the start of the pandemic, with 82% of women declaring their financial situation had worsened compared to 83% of men[3], it seemed to take longer for women’s situations to improve, with 85% still saying their financial situation had worsened compared to 80% of men[4] at the end of 2020. The difference between the impact of the crisis on men and women was especially acute in some markets, in Cameroon for example 77% of female clients said their financial situation was much worse compared to 59% of men.

Advans has always aimed to champion gender equality and offer the same access to financial services for men and women but these insights into women’s increased financial vulnerability encouraged Advans to dig deeper into how it could better support female clients going forward. Advans received support from CDC+ to benefit from the expertise of global impact firm Palladium Impact Capital, who helped the group realise that having a more systematic gender-smart approach, embedded in all areas of work, was a necessity to better serve women and foster their financial inclusion.

As well as looking at Advans’ group strategy, Palladium supported gender projects in two key markets: Cameroon and Ghana; The project consisted in analysing the data on Advans female clients, performing qualitative field studies with clients in both markets, as well as a staff survey to establish the level of internal gender awareness. These elements were all used to inform the definition of a gender strategy going forward and training for field staff.

Here are some key lessons coming out of this experience which will inform Advans’ future gender strategy.

1. Financial service providers need to look at how many women they are serving but also which female clients they are serving to inform their strategy.

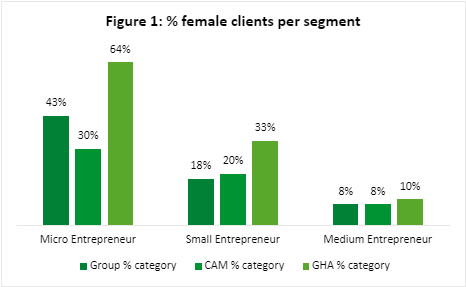

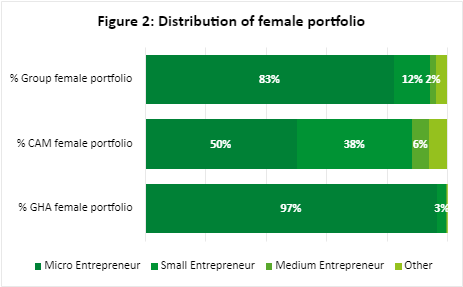

Female clients should not, as research shows, be treated as a homogenous group.[5] Advans’ main client targets are entrepreneurs split intomicro, small and medium segments. Data analysis showed that female entrepreneur clients, in the majority, are in what Advans considers the micro segment, and are less present in the small and medium segments. In Ghana, Advans has a majority of female clients, in line with the high number of female led businesses in the country[6], and over 60% of the micro segment are women. It was therefore decided to concentrate initially on studies with micro female ‘Striver’ clients: female micro entrepreneurs with a high business potential but in need of extra support to boost their growth. In Cameroon, which has more small and medium clients, Advans decided to target these two larger segments during focus groups. The objective for these studies was really to get a more in-depth idea of the barriers these different female entrepreneur profiles were encountering and what their needs were to inform each institution’s strategy going forward.

2. Both financial and non-financial services can help female entrepreneurs overcome barriers to business growth.

Data showed that women entrepreneurs were less likely to be formalised and asked for smaller loan sizes compared to men even within the same segment. Access to capital remains one of the key barriers to growth for women at all levels, but it’s a vicious cycle because they often don’t have the collateral, formalisation or level of record keeping required to get a bigger loan. These issues came up in both Cameroon and Ghana and led us to two key conclusions: i) defining how to make collateral more flexible for women is key to increasing access to finance and ii) in order to help women grow in the long term, additional services like coaching or digital accounting tools could have a greater benefit. This is in line with industry learning: FMO and IFC suggest that providing non-financial services to women owned SMEs can not only help women SMEs to flourish, but also improve the performance of the financial institution[7]. Advans Tunisie launched a coaching programme in 2020 for both male and female clients who were badly affected by the Covid crisis and having repayment difficulties, with over 300 female clients benefitting from personalised coaching via phone. 89% of beneficiaries of this programme said it had a positive impact on their activity[8], with on time repayment and PAR 30 improving especially for female participants.

3. Financial service providers need to actively assist and better communicate with female clients to help them benefit from products and services.

Women tend to be more interested in getting full and complete information on financial services[9]. Advans data analysis showed that women had lower savings balances in general and activity rates on accounts fluctuated. In Ghana for example women have more active accounts on average but are less active in terms of transactions and few of the micro “Strivers” interviewed talked about saving. In Cameroon, small entrepreneur female clients wanted more information on services and lacked trust in digital services especially. This is in line with the information from our Covid study which showed that women were less sure that their use of digital services would increase in future compared to male clients (54% vs 59%)[10]. The non-use of services could therefore be linked to issues either of communication or of lack of familiarity, especially with technology. To ensure that women are fully benefitting from services, it is therefore essential to provide the right information and support when onboarding female clients, help them use services – particularly digital – and adapt and simplify value propositions to align with their goals. Advans Cameroun has started piloting some actions on this for example providing financial education sessions to female clients, lowering minimum savings account balances to facilitate access and using female client ambassadors to talk about their experience with Advans to potential female clients.

4. Staff buy in is key to deploying a gender-smart approach and tailor the customer experience for women.

Financial service providers need to look to build front line staff’s capacity to have a fully gender sensitive approach.[11] Palladium’s study showed that there was a need to better train Advans staff on how having a gender smart approach could be beneficial. Field staff need to be convinced of the business case for serving women but most importantly understand why sales approaches should be adapted to better suit women’s needs. Palladium helped teams in Cameroon and Ghana with some initial training materials on this and Advans Cameroun has started rolling out training on a gender smart approach and coaching in branches. Advans also aims to test a more tailored female client journey. Focusing on improving the customer experience for women will increase satisfaction and in turn help Advans to reach out to more female clients who, according to the results of the recent 60 Decibels Financial Inclusion Index done in several Advans subsidiaries, are more likely to recommend Advans than men.[12]

5. Finally, in the long term, serving women better may help Advans have a wider impact on communities and livelihoods.

The 60 Decibels studies also showed that in Ghana, women tended to be more likely to report that Advans had a positive impact on their quality of life than men, with women especially increasing their spending on home improvement, education and healthcare. In Cameroon, although the impact on quality of life was slightly lower for women clients, women tended to have increased their spending more on healthcare[13]. These results show that women clients are probably more likely to invest in key life improvements for their families, and that by supporting women clients, Advans can have a wider impact on the communities in which it operates as a whole. All the more reason to better support their businesses, facilitate access to services and improve the female customer experience.

So what’s next for Advans and gender-smart financial inclusion?

Advans is currently piloting several of these ideas in Cameroon with the subsidiary’s specific female targeted campaign “Elle Advans”, while in Ghana the institution is looking to further understand the small female client segment (in compliment to the initial studies on Micro “Strivers”) before defining its overall gender strategy. Advans also has a key project starting in Tunisia to better understand the barriers to access for women clients. Even though Advans has group objectives and ambitions, each country needs to define its own path to improve financial inclusion for women, adopting these five key learnings to their specific context.

Advans aims to use these key first learnings to enrich its overall gender strategy, share experiences between subsidiaries and refine its global gender smart road map for the years to come with one overall objective: a better approach to women’s financial inclusion for a wider impact on their businesses, families, and communities.

[1]www.unwomen.org/en/news/stories/2020/8/press-release-covid-19-will-widen-poverty-gap-between-women-and-men

[2]Conducted by 60 Decibels with 3,054 clients in Cambodia, Cameroon, Ghana, Nigeria Pakistan, Tunisia, Myanmar (Study supported by FMO)

[3] 678 female respondents and 791 male respondents R1

[4] 739 female respondents and 646 male respondents R2

[5]www.cgap.org/blog/3-ways-deepen-our-understanding-womens-financial-inclusion

[6] Mastercard Index of Women Entrepreneurs 2019 (Ghana is considered as an outlier with 37.9% of women business owners) Mastercard-Index-of-Women-Entrepreneurs-Report-2019-v1.0.pdf

[7] Non-Financial Services: The Key to Unlocking the Growth Potential of Women-led Small and Medium Enterprises for Bank, FMO & IFC, 2020: Link to report

[8] Results of survey with 840 beneficiaries of the programme (which included 328 women)

[9] The Paradox of Gender-Neutral Banking, Global Banking Alliance, 2016 (p.10): Link to report

[10] Advans Covid 19 Study conducted by 60 Decibels with 3,054 clients in Cambodia, Cameroon, Ghana, Nigeria Pakistan, Tunisia, Myanmar (Study supported by FMO)

[11] A comprehensive framework for gender centrality in financial services, MSC, Briefing Note #175, 2018: Link to report

[12] According to NPS scores in the 60D Financial Inclusion Index results, CAM and GHA: 151 female clients /255 clients Ghana 62 female clients/256 clients Cameroon.

[13] 60D Financial Inclusion Index results, CAM and GHA: 151 female clients /255 clients Ghana 62 female clients/256 clients Cameroon.